New York State Law requires all private employers to provide written notice to employees of their rate(s) of pay and designated pay day on an annual basis. Notice must be provided between January 1 and February 2 2013. NYS' FAQ on the Wage Theft Prevention Act specifically states that an employer may not choose another time of the year to provide the notice!

A Pay Rate Notice is always required at the time of hire (a written work agreement with the appropriate language will serve this function). Additionally, notice must be provided within 7 days of a change in pay rates if the change is not listed on an employee's pay stub. The federal Fair Labor Standards act designates domestic service employees (nannies, housekeepers, elder care providers) as non-exempt employees. Domestic service workers are covered by minimum wage and overtime rules, and must be paid an agreed amount for every hour on duty.

A Pay Rate Notice is always required at the time of hire (a written work agreement with the appropriate language will serve this function). Additionally, notice must be provided within 7 days of a change in pay rates if the change is not listed on an employee's pay stub. The federal Fair Labor Standards act designates domestic service employees (nannies, housekeepers, elder care providers) as non-exempt employees. Domestic service workers are covered by minimum wage and overtime rules, and must be paid an agreed amount for every hour on duty.

When using a weekly payroll service such as HomeWork Solutions' NaniPay, pay stubs will be compliant if the employer has provided the appropriate hourly rate information in the employee profile. If there are multiple rates (commonly hourly and overtime) these must and will be listed.

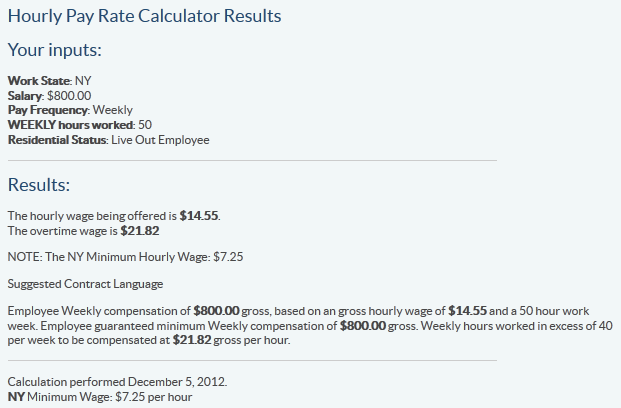

Do you pay a 'flat rate' to your household employee for the work performed? Take the time to translate this into an hourly rate - this action protects YOU. Your nanny generally works 45 hours a week but may work as many as 50 at some times, and as little as 30 other. You offer her $800 per week. How do you figure out what her hourly rate is? HWS recommends you base your calculations on the maximum weekly hours you anticipate, in this case 50. The HWS Hourly Rate Calculator Tool will do the translation for you and provide you FLSA compliant work agreement language. See below:

This is important! There are many organizations in New York and nationwide dedicated to informing household workers of their legal rights and assisting them with claims for unpaid wages. It is prudent for the household employer to put the minimal effort needed into properly documenting the work arrangement, pay arrangement, and the calculation of payroll.

New York household employers, may we remind you that in addition to the pay rate documentation issues above, you are also required to maintain accurate and contemporaneous time tracking records, pay your employee on a weekly basis, offer paid time off, pay overtime, and other responsibilities as required by the NY Domestic Employee Bill of Rights (linked below).

Resources:

- NY Pay Rate Notice for Household Employers (English)

- NY Pay Rate Notice for Household Employers (Spanish)

- 10 Tips: NY Domestic Workers' Rights

- Wage Theft Prevention Act Frequently Asked Questions

- Hourly Pay Rate Calculator (translates 'salary' to hourly rate terms)

- New York Domestic Employer's Bill of Rights FAQ

- Common Legal and Payroll Mistakes of Household Employers